5 Convert How To Avoid Capital Gains Tax On Stocks - How to avoid capital gains tax on stocks. Depending on the state you live in, you’ll have to fork over more money.

How to avoid capital gains tax on stocks

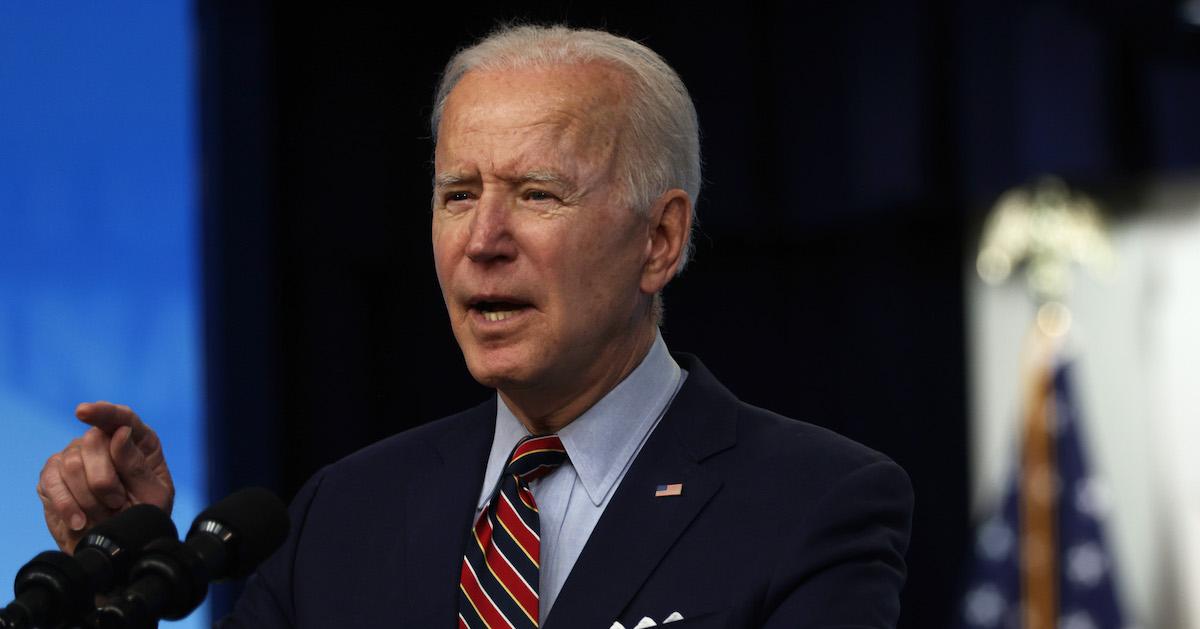

7 Efficient How To Avoid Capital Gains Tax On Stocks. Remember that your capital gains tax rate is based on your income, so your capital gain tax rate will be lower as well. Hope this article helped you understand researched and easy ways to avoid paying taxes such as capital gains on selling your stocks and let us know if these tips helped you in the comment section below! As president biden proposes significant increases in capital. How to avoid capital gains tax on stocks

How to avoid capital gains tax on stocks. With all of these accounts, you can buy and sell stocks without being charged capital gains tax — ever. A “capital gains tax” is an amount you are obligated to pay on your capital gain from selling stocks, bonds, or any other capital asset. How to avoid capital gains tax on stocks

One way to avoid capital gains on stocks is to be below a certain income level. This percentage could be as low as 0% or as high as your ordinary tax. State capital gains tax on stocks the federal government is going to take a bite out of your profits, but don’t think the taxes stop there. How to avoid capital gains tax on stocks

How to avoid capital gains tax on a home sale · live in the house for at least two years. Luckily, there are a few ways investors can avoid the capital gains tax on stocks. These include iras, roth iras, 401ks, and 403bs. How to avoid capital gains tax on stocks

If you have funds in an old. This could result in no capital gains at. How to avoid capital gains tax on stocks: How to avoid capital gains tax on stocks

The simplest is not to sell the stock, although even that is not a sure bet. That said, there are many ways to minimize or avoid the capital gains taxes on stocks. Estate or invest in various real estate projects. How to avoid capital gains tax on stocks

But there are several other ways to lessen or. Depending on how your gains are classified, and your total taxable income for the year, your capital gains tax rate can vary. Capital losses of any size can be used to offset capital gains on your tax return to determine your net gain or loss for tax purposes. How to avoid capital gains tax on stocks

Most people are going to fall into that 15% category. Stay in a lower tax bracket. If you are in a lower capital gain tax bracket, potentially even the 0% bracket, it makes sense to go ahead and harvest those gains now to avoid having to do it later when your taxable income is higher. How to avoid capital gains tax on stocks

When stocks, real estate and other types of investments are sold for a profit — meaning they earned the owner income because they sold at a If you’re a retiree or in a lower tax bracket ( less than $75,900 for married. Because capital gains are added to assessable income and are taxed at the marginal income tax rate, this may increase the tax an investor needs to pay and reduce the net return from investing significantly. How to avoid capital gains tax on stocks

How could the changes impact stocks? And you will also want to hold your shares for more than one year. Although it’s referred to as capital gains tax (cgt), this is actually part of the income tax regime and not a separate tax. How to avoid capital gains tax on stocks

Reinvest in an opportunity zone in 2017, congress passed the tax cuts and jobs act to help revive economically troubled communities. 5 ways to avoid paying capital gains tax when you sell your stock. If you were to buy 1,000 shares of a company at $30 each and then sell those same shares for $50 later, you'd owe capital gains tax on the $20,000 in profit you made. How to avoid capital gains tax on stocks

In fact, it’s possible for you to pay 0% in capital gains tax… with a little foresight and planning. The legislation allows those who reinvest their capital gains in these “opportunity zones” some substantial tax benefits. Currently, inherited stocks avoid capital gains, but a new proposal would change that tax rule. How to avoid capital gains tax on stocks

First, remember that if you hold stock for less than a year and then sell it, the tax calculation will be for. Capital gains tax (cgt) can get a little complex at times, but with a little planning it is possible to avoid paying it a lot of the time. How to avoid capital gains tax on stocks