13 Unexpected How To Find Your Agi From 2019 - If you need help, contact a. Your income will include your salary, prizes, lottery, rents, jury duty fees, unemployment benefits, etc.

How to find your agi from 2019

7 Genius How To Find Your Agi From 2019. First, you will have to gather your income and tax statements. Adjusted gross income is your taxable income for the year, so it is what your income tax bill is based on. In addition, you’ll also need access to your email, your account number from a credit card, mortgage, or home equity loan, and a mobile phone number in your name. How to find your agi from 2019

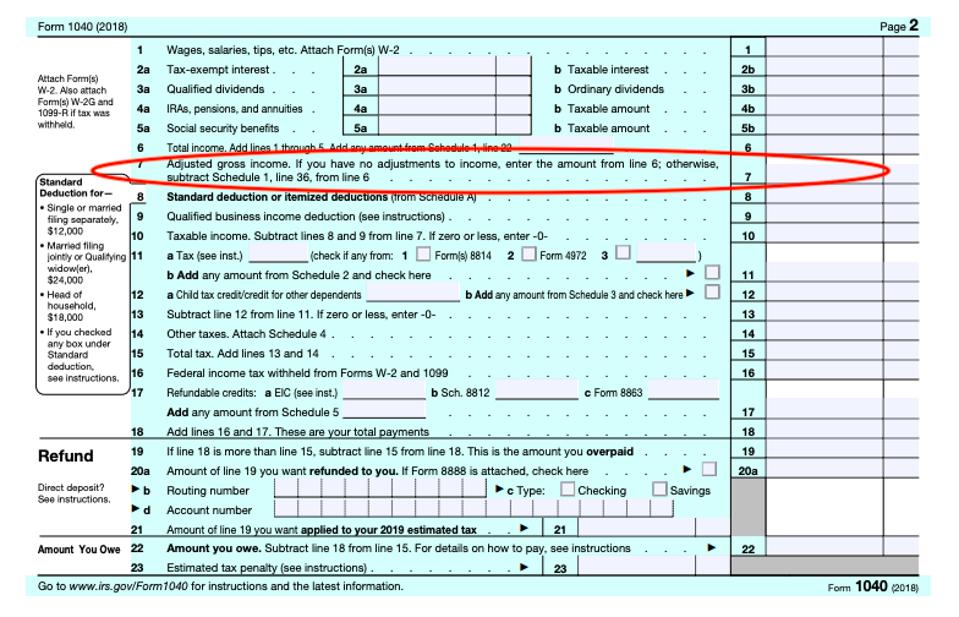

Your 2020 agi will be on line 11 of form 1040. How to calculate adjusted gross income (agi) use this adjusted gross income formula to determine your agi: The first step in computing your agi is to determine your total gross income for the. How to find your agi from 2019

Your adjusted gross income of from 1040 page 1 line no 11 is originated from form 1040 schedule 1, and it is a combination of below mentioned allowable. To find your agi, select the option below that best describes your situation. After you have the correct agi. How to find your agi from 2019

Follow these steps for resolutions to the current 2020 agi issue. The amount of your agi directly influences your eligibility to claim many of the deductions and credits available on your tax return. Complete form 4506 request for copy of tax return. How to find your agi from 2019

Nevertheless, the irs recommends that you always file your tax return because if you do not owe the government, the government may be owing you, which means you're eligible for a tax refund. Note that any link in the information. Then go through each deduction and see if you can claim it. How to find your agi from 2019

How do i find last year’s agi? Not only does it impact the tax breaks you’re eligible for—your agi is now also a kind of identification. If you’re filing your 2021 tax return, and you filed a tax return for 2020, then you can find your prior year agi by looking at your 2020 form 1040, line 11. How to find your agi from 2019

Once you get your tax transcript, you’ll find your agi on the. Special instructions to validate your 2021 electronic tax return if your 2020 tax return has not yet been processed, enter $0 (zero dollars) for your prior year adjusted gross income (agi). There are a few places you can get. How to find your agi from 2019

Determining your adjusted gross income is essential in the tax filing process. If you itemize deductions and report medical expenses, for example, you must reduce the total expense by 7.5% of your agi for 2021. To retrieve your original agi from your 2019 tax return (or from the original return if you filed an amended return), you may do one of the following: How to find your agi from 2019

First, it includes all your income sources, such as: 1) this might result in your 2021 tax return rejection, as your 2020 agi might not be on file with the irs yet. Before you begin computing your agi for tax purposes, you may want to find out if you need to file a tax return for the year. How to find your agi from 2019

There are two steps to finding your agi. Add these together to arrive at your total earned income. It not only determines your tax bracket, but also tells you. How to find your agi from 2019

You can find your agi on box no 1 of your w2, this income is a combination of your wages, tips, compensation and also addition of boxes of 2 to 14. Generally as a result of the coronavirus during 2020 and 2021, nearly 7 million 2019 and 2020 tax returns have not been processed by the irs as of 2022. Start with your gross income. How to find your agi from 2019

Your adjusted gross income (agi) is your total income from all sources, minus allowable deductions. You need your 2019 agi to sign and file your 2020 tax return. Add up all of these sources of income to find out the final annual income. How to find your agi from 2019

Use your adjusted gross income (agi) to validate your electronic tax return. Your agi is the total amount of income you make in a year, minus certain expenses that you are allowed to deduct. You can find it on line 8b of your 2019 return (form 1040). How to find your agi from 2019

If your spouse had a different agi, you’ll need his or her information to get their agi from the irs. So, if you report $10,000 in medical expenses and an agi of $100,000; Adjusted gross income (agi), or your income minus deductions, is important when calculating your total tax liability. How to find your agi from 2019

Here are some tips for doing so. How to find your agi from 2019